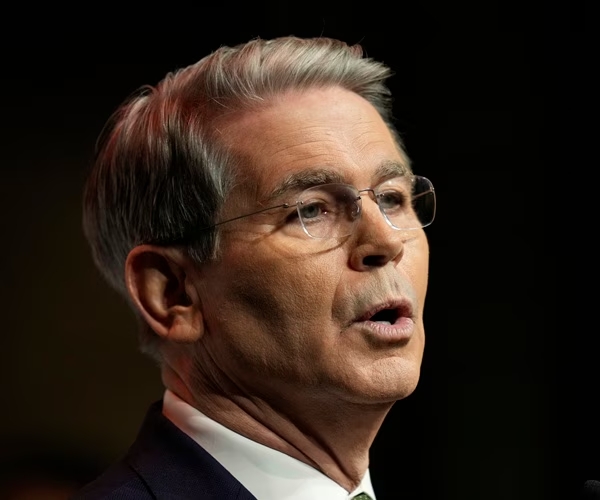

Treasury Secretary Scott Bessent made it clear Sunday that the Federal Reserve is in no rush to start slashing its massive balance sheet, even if Kevin Warsh—known for criticizing the Fed’s bond-buying habits—takes over as chairman. Translation: don’t expect any sudden financial gymnastics.

Speaking on Fox News Channel’s “Sunday Morning Futures,” Bessent said the Fed could take as long as a year just to decide what it wants to do with its balance sheet. He also emphasized that Warsh would be a highly independent Fed chief.

“That will be up to the Fed in terms of what they want to do with the balance sheet,” Bessent said. “I wouldn't expect them to do anything quickly if they move to an ample (reserves) regime policy, and that does require a larger balance sheet. So, I would think that they'll probably sit back, take at least a year to decide what they want to do.”

The Fed’s balance sheet ballooned during the global financial crisis and again during the COVID-19 pandemic as it tried to push down long-term interest rates. It peaked at $9 trillion in the summer of 2022 before being trimmed through quantitative tightening to about $6.6 trillion by late 2025.

Then, in December, the Fed reversed course slightly and began increasing its bond holdings again through technical purchases of Treasury bills. The goal was to make sure there was enough liquidity in the financial system to maintain firm control over its interest rate target range—because nothing says “simple” like trillions of dollars in fine-tuning.

Warsh, who served as a Fed governor from 2006 to 2011, has argued that large Fed holdings distort the economy and that the balance sheet should be cut down significantly. He has been one of the louder voices saying the central bank’s massive footprint isn’t exactly healthy for markets.

President Donald Trump has said he wants mortgage rates to be much lower, and shrinking the Fed’s balance sheet would work against that goal and could be difficult to pull off while keeping financial stability intact, according to experts.

For now, Bessent’s message is that patience is the plan. The Fed may rethink its balance sheet, but it won’t be rushing into anything that could rock the system. Under Trump’s push for lower rates and Warsh’s call for reform, the direction is clear: steady hands, careful steps, and no reckless moves with the world’s biggest financial engine.