By Rita Nazareth. Media: Bloomberg

Stocks struggled to find solid ground after a rally that put the market near a record on bets the Federal Reserve will cut rates next year.

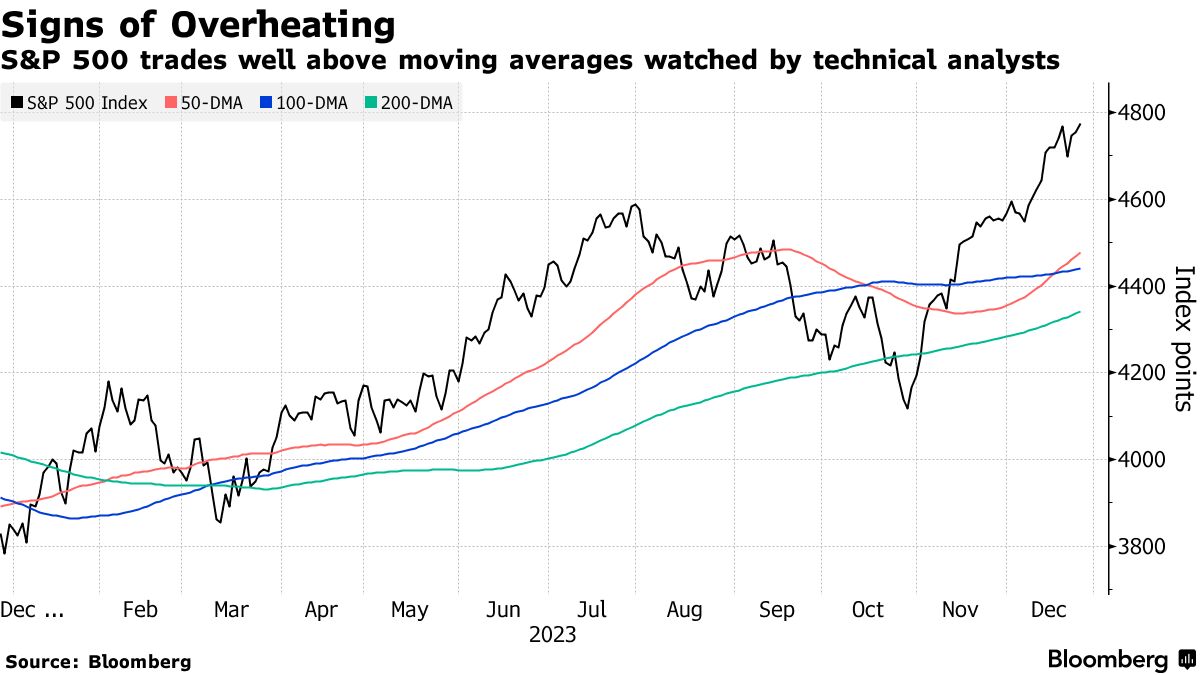

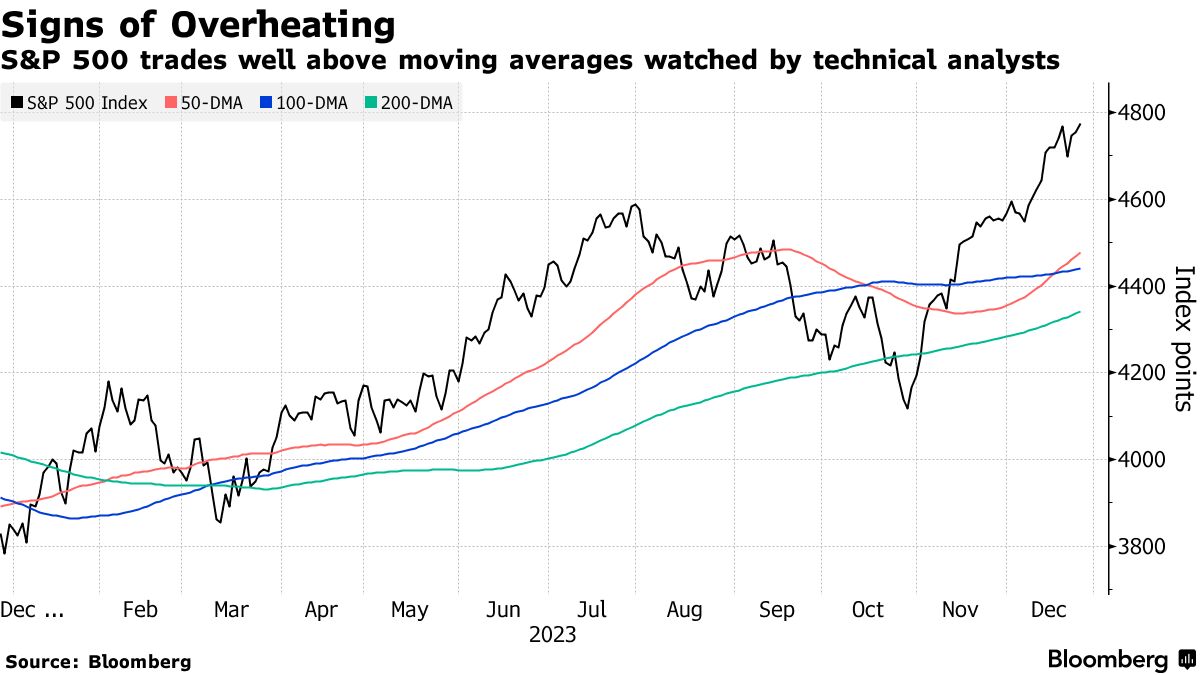

Without any major economic data or significant corporate events, the S&P 500 wavered. With just a few days left before the end of 2023 — when volume tends to shrink — some traders are citing an old Wall Street adage that says “never short a dull market.” Yet concerns about a reality check have surfaced amid overbought levels and warnings about overly dovish Fed wagers.

“The ‘Santa rally’ has left many investors complacent,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “As we start 2024, markets will need to see new, positive catalysts to send the S&P 500 to new all-time highs.”

Traders have stepped up bets on rate cuts as early as March 2024, according to Fed swaps pricing. That view has gained momentum since policymakers updated their forecasts this month to show they expect to reduce rates at a stronger pace than indicated in their previous projections in September.

The S&P 500 traded less than 0.5% away from its all-time high of 4,796.56. Treasuries held small gains ahead of a $58 billion sale of five-year notes — a day after shorter maturities drew strong demand from buyers seeking to lock in higher yields before the Fed starts easing policy.

[caption id="attachment_11116" align="alignnone" width="1200"]

Charts[/caption]

“The stock market is too optimistic about the quantity of rate cuts expected in 2024,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “We may be borrowing some of 2024’s gains now as the year-end rally continues because we don’t expect to see as many rate cuts as the market is currently predicting.”

Optimism about the Fed having potentially won the war against inflation is, at best, excessive as data in coming months will likely persuade the Fed to delay rate cuts until May at the earliest, according to Jose Torres at Interactive Brokers.

“The strong optimism about a rate cut that has been supporting equity and bond prices may face a cold reality, which sparks increased market volatility if the Fed maintains its current restrictive position until May or June,” Torres added.

Geopolitics

Traders also kept an eye on the latest geopolitical developments. Oil retreated from its highest close in almost a month, with a new attack on shipping in the Red Sea underscoring why some vessels are avoiding the key route. Shipping giant Hapag-Lloyd AG said it will keep its vessels away from the Red Sea even after the launch of a US-led taskforce to protect the key trade route from militant attacks.

In other corporate news, Cytokinetics Inc. said its experimental drug helped patients with a genetic heart ailment in a closely watched trial that has spurred speculation about a potential takeover. Pipeline operator Williams Cos. agreed to buy natural gas storage assets from an affiliate of Hartree Partners LP for $1.95 billion in a bet on demand growth for the fuel in the US and in overseas markets.

Elsewhere, Bitcoin recovered amid renewed speculation that the US securities regulator is getting close to approving an exchange-traded fund investing directly in the biggest token.

Key events this week:

- Japan industrial production, retail sales, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- UK Nationwide house prices, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 10:01 a.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.1%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.6% to $1.1103

- The British pound rose 0.3% to $1.2768

- The Japanese yen fell 0.1% to 142.57 per dollar

Cryptocurrencies

- Bitcoin rose 1.5% to $42,970.5

- Ether rose 4.9% to $2,332.83

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.84%

- Germany’s 10-year yield declined six basis points to 1.92%

- Britain’s 10-year yield declined four basis points to 3.46%

Commodities

- West Texas Intermediate crude fell 0.8% to $74.94 a barrel

- Spot gold was little changed

Charts[/caption]

“The stock market is too optimistic about the quantity of rate cuts expected in 2024,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “We may be borrowing some of 2024’s gains now as the year-end rally continues because we don’t expect to see as many rate cuts as the market is currently predicting.”

Optimism about the Fed having potentially won the war against inflation is, at best, excessive as data in coming months will likely persuade the Fed to delay rate cuts until May at the earliest, according to Jose Torres at Interactive Brokers.

“The strong optimism about a rate cut that has been supporting equity and bond prices may face a cold reality, which sparks increased market volatility if the Fed maintains its current restrictive position until May or June,” Torres added.

Geopolitics

Traders also kept an eye on the latest geopolitical developments. Oil retreated from its highest close in almost a month, with a new attack on shipping in the Red Sea underscoring why some vessels are avoiding the key route. Shipping giant Hapag-Lloyd AG said it will keep its vessels away from the Red Sea even after the launch of a US-led taskforce to protect the key trade route from militant attacks.

In other corporate news, Cytokinetics Inc. said its experimental drug helped patients with a genetic heart ailment in a closely watched trial that has spurred speculation about a potential takeover. Pipeline operator Williams Cos. agreed to buy natural gas storage assets from an affiliate of Hartree Partners LP for $1.95 billion in a bet on demand growth for the fuel in the US and in overseas markets.

Elsewhere, Bitcoin recovered amid renewed speculation that the US securities regulator is getting close to approving an exchange-traded fund investing directly in the biggest token.

Key events this week:

- Japan industrial production, retail sales, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- UK Nationwide house prices, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 10:01 a.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.1%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.6% to $1.1103

- The British pound rose 0.3% to $1.2768

- The Japanese yen fell 0.1% to 142.57 per dollar

Cryptocurrencies

- Bitcoin rose 1.5% to $42,970.5

- Ether rose 4.9% to $2,332.83

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.84%

- Germany’s 10-year yield declined six basis points to 1.92%

- Britain’s 10-year yield declined four basis points to 3.46%

Commodities

- West Texas Intermediate crude fell 0.8% to $74.94 a barrel

- Spot gold was little changed

Charts[/caption]

“The stock market is too optimistic about the quantity of rate cuts expected in 2024,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “We may be borrowing some of 2024’s gains now as the year-end rally continues because we don’t expect to see as many rate cuts as the market is currently predicting.”

Optimism about the Fed having potentially won the war against inflation is, at best, excessive as data in coming months will likely persuade the Fed to delay rate cuts until May at the earliest, according to Jose Torres at Interactive Brokers.

“The strong optimism about a rate cut that has been supporting equity and bond prices may face a cold reality, which sparks increased market volatility if the Fed maintains its current restrictive position until May or June,” Torres added.

Geopolitics

Traders also kept an eye on the latest geopolitical developments. Oil retreated from its highest close in almost a month, with a new attack on shipping in the Red Sea underscoring why some vessels are avoiding the key route. Shipping giant Hapag-Lloyd AG said it will keep its vessels away from the Red Sea even after the launch of a US-led taskforce to protect the key trade route from militant attacks.

In other corporate news, Cytokinetics Inc. said its experimental drug helped patients with a genetic heart ailment in a closely watched trial that has spurred speculation about a potential takeover. Pipeline operator Williams Cos. agreed to buy natural gas storage assets from an affiliate of Hartree Partners LP for $1.95 billion in a bet on demand growth for the fuel in the US and in overseas markets.

Elsewhere, Bitcoin recovered amid renewed speculation that the US securities regulator is getting close to approving an exchange-traded fund investing directly in the biggest token.

Key events this week:

- Japan industrial production, retail sales, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- UK Nationwide house prices, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 10:01 a.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.1%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.6% to $1.1103

- The British pound rose 0.3% to $1.2768

- The Japanese yen fell 0.1% to 142.57 per dollar

Cryptocurrencies

- Bitcoin rose 1.5% to $42,970.5

- Ether rose 4.9% to $2,332.83

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.84%

- Germany’s 10-year yield declined six basis points to 1.92%

- Britain’s 10-year yield declined four basis points to 3.46%

Commodities

- West Texas Intermediate crude fell 0.8% to $74.94 a barrel

- Spot gold was little changed