Americans could be in for a very pleasant surprise when they file their taxes early next year.

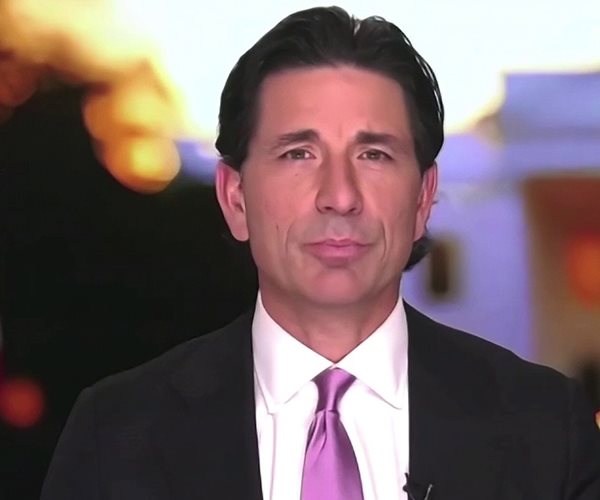

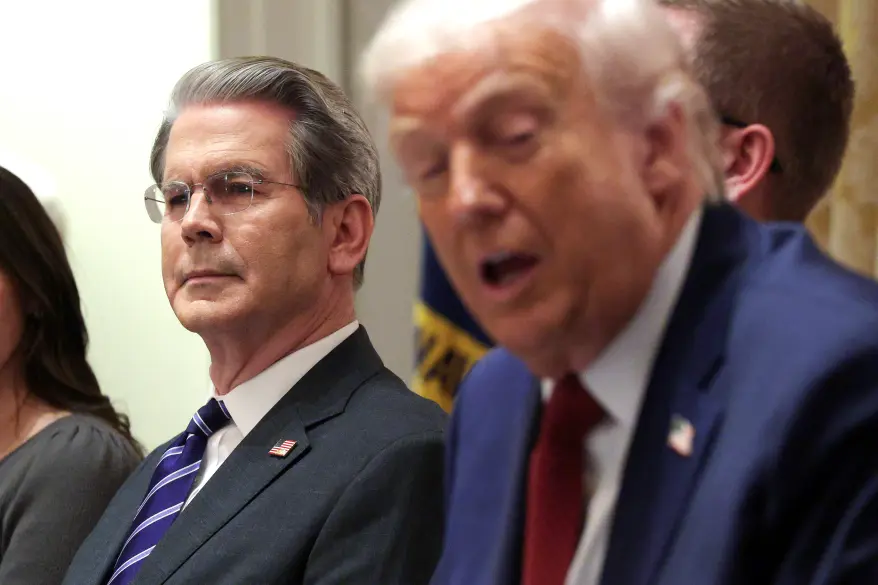

Treasury Secretary Scott Bessent says refund checks during the 2026 filing season will be “gigantic,” thanks to the tax cuts included in President Trump’s One Big Beautiful Bill Act.

Speaking on the All-In Podcast, Bessent explained that the law’s tax provisions were made retroactive to the start of the year, but most workers never adjusted their paycheck withholdings after the bill became law. The result? Millions of Americans have been overpaying the IRS all year — and they’re about to get that money back.

“I can see that we’re gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings,” said Bessent, who is also serving as acting commissioner of the IRS.

“I think households could see, depending on the number of workers, $1,000 to $2,000 refunds,” he added.

Those numbers line up with projections from the nonpartisan Tax Foundation, which estimates the average refund for tax year 2025 will reach $3,800 — a sharp jump from $3,004 in 2023 and $3,052 in 2024.

“When taxpayers file their 2025 tax returns in 2026, many will see larger refunds than in recent years,” said Tax Foundation analyst Erica York. “That’s due to the One Big Beautiful Bill Act, which reduced individual income taxes for 2025 by an estimated $144 billion.”

York noted that because the IRS did not update withholding tables after the bill passed, workers continued having too much money taken out of their paychecks.

“Instead of gradually receiving the benefit of the tax cuts through higher take-home pay during the year,” she explained, “most taxpayers will receive it all at once when they file their returns.”

Bessent said that dynamic is about to change.

He expects many workers will adjust their withholding schedules next year, meaning they’ll see larger paychecks and still benefit from the one-time refund boost — a combination he believes will significantly strengthen household finances.

“They will change their withholding schedule at the beginning of the year and they will get an automatic increase in real wages,” Bessent said. “So I think that’s going to be a very powerful combo.”

Trump’s One Big Beautiful Bill Act included a slate of tax relief provisions aimed squarely at working Americans and families, including:

-

A larger child tax credit

-

An increased standard deduction

-

A higher SALT deduction cap

-

New deductions for auto loan interest

-

Tax relief for overtime pay and tipped income

In short, while critics warned the bill would never benefit everyday Americans, the numbers are now telling a very different story — one that could hit bank accounts in a big way just months from now.