By Sterling Mosley. Media: DC Enquirer.

Note: This article may contain commentary reflecting the author’s opinion.

On Monday, the American regional banking sector went into freefall as banks across the country were impacted by the collapse of Silicon Valley Bank on Friday and Signature Bank on Sunday. Both events mark the second and third biggest bank collapses in American history just behind the 2008 financial crisis.

Some of the banks that have nosedived are massive regional banks including Truist Financial Corp, the 10th largest bank in the country, seeing their stock plunge 20 percent.

Other stocks still in freefall include Western Alliance, which has been halted repeatedly and has seen its stock drop 72 percent.

First Republic has seen its stock plummet 73 percent, Fifth Third bank is down 25 percent, and Comerica is down 50 percent as of this report.

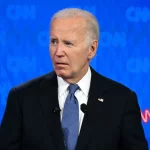

The halting of multiple bank stocks comes after President Biden addressed the nation Monday morning to reassure the American people that the banking system is safe.

In his address, the president reassured the nation that his administration has confidence in the overall banking system and that both banks will not be getting a bailout.

“Americans can have confidence that the American banking system is safe. Your deposits will be there when you need them,” Biden said. “Small businesses across the country that deposited accounts in these banks can breathe easier knowing they’ll be able to pay their workers and pay their bills. And their hard-working employees can breathe easier as well.”

The president also added that the management within both banks will be fired and the investors will not be getting anything following the collapse.

Biden explained that the investors took the risk to invest in a risky bank and thus they should reap the consequences when it fails.

The president also assured depositors in these banks that their funds will be available to them starting Monday, adding that the funds will not be insured via American tax dollars but instead via fee payments that the two banks paid.

“No losses will be borne by the taxpayers. Instead, the money will come from the fees that banks pay into the deposit insurance fund,” the president explained. “Because of the actions that our regulators have already taken, every American should feel confident that their deposits will be there when and if they need them.”

The president then explained that his administration will work to ensure that these outcomes do not occur again. In so doing, he blamed President Trump’s administration for loosening regulations during his presidency, however, he was not specific in his accusation.

The president should take full responsibility for the second-biggest banking collapse in American history instead of blaming his predecessor for his failure.

President Biden did not take any questions following the address.