By Zachary Halaschak, Economics Reporter. Media: Washington Examiner.

Annual inflation slowed to a 4% rate in May, the Bureau of Labor Statistics reported Tuesday, down from 4.9% the month before.

Tuesday’s report marks 11 straight months of declines in annual inflation after the rate peaked at a whopping 9.1% in June of last year. The sharp drop in headline inflation is a positive development as the Federal Reserve convenes Tuesday to decide whether to continue aggressively raising interest rate hikes as it has over the past year in a desperate bid to limit price hikes.

The large decline in the annual inflation rate was driven by the massive jump in May 2022 falling out of the equation. Prices rose nearly 1% just in that month, thanks in large part to soaring energy costs and supply-chain disruptions caused by Russia’s invasion of Ukraine. Energy costs have since fallen significantly.

“Nothing like 11 consecutive months of declining CPI. It shows the Fed’s policy approach has been taking hold and working,” Brian Marks, executive director of the University of New Haven’s Entrepreneurship and Innovation Program, told the Washington Examiner.

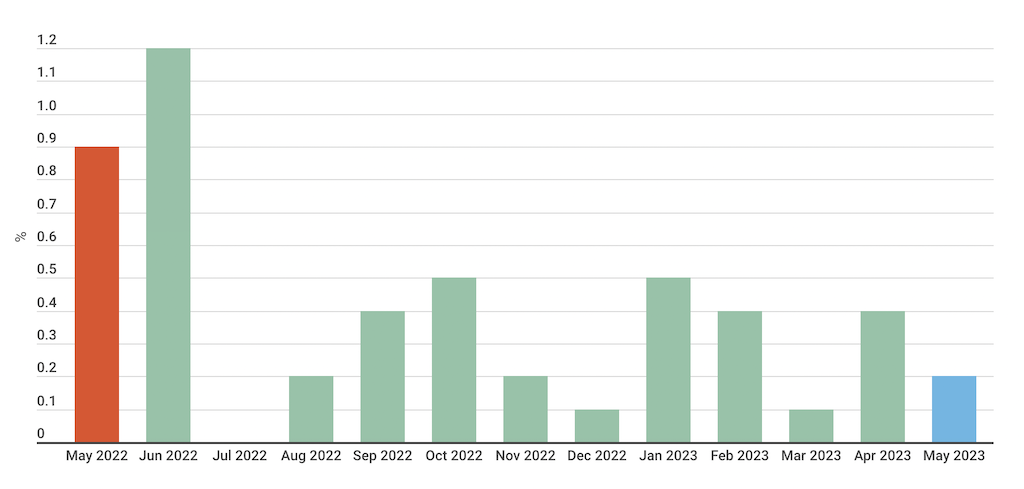

Month-to-month inflation

The year-over-year inflation rate is falling because an extremely high month-to-month increase for May of 2022 (in red) is being replaced in the calculation by a much smaller increase for May of this year (in blue)

Bureau of Labor Statistics

Still, details from Tuesday’s report show that underlying price pressures are still strong. “Core inflation,” which strips out volatile food and energy prices, fell 0.2 percentage points to 5.3% in the year ending in May.

The rising cost of food, in particular, has been difficult for many households. The price of bread has risen 12.5% over the last year, while dairy products have increased in price by 4.6%.

Meanwhile, some energy products, such as gasoline, fell on a month-to-month basis, and many items were down heavily from the year before. Regular unleaded gasoline fell 20.3% on an annual basis, while fuel oil dropped some 37%.

This week, the Fed convened a two-day meeting to discuss its monetary policy. The Fed is set to make a highly anticipated announcement on Wednesday about whether it will raise its interest rate target again.

Prior to Tuesday’s latest CPI report, most investors expected the Fed will pause its rate hiking to assess whether it has sufficiently tightened.

As of Monday, investors assigned about a 75% chance that the Fed will pause rate hiking, according to CME Group’s FedWatch tool, which calculates the probability using futures contract prices for rates in the short-term market targeted by the Fed. Just 1 in 4 thought the Fed will hike again.

The Fed’s current target range is between 5% and 5.25%.

Soaring inflation has battered households over the past two years and upended some support for President Joe Biden and his economic agenda. Republicans have used the rising prices as a cudgel to attack the administration and have blamed big spending bills, such as Biden’s pandemic relief legislative package, as major drivers of inflation.

The Fed’s next move with its interest rate target is being closely scrutinized as it comes against the backdrop of several other big economic stories, such as banking sector turmoil, a weakened housing market, and fears of broad-based recession.

The country’s banking sector is still being closely watched following the sudden failure of Silicon Valley Bank in March. SVB’s downfall acted as a bit of a domino and led to a few other bank collapses, as well as some regional banks seeing their stock values plunge.

The federal government was able to step in and stymie the worst of the fallout, but economists are still keeping an eye on the banking system, given the overall volatility of the economy amid the Fed’s rate hiking.

While the economy as a whole is not in a recession, many economists argue the housing market is in a recession. Home prices are falling, a sign of just how much the market has cooled since its peak in 2020, when the Fed slashed rates to near-zero and mortgage rates fell in response, causing demand to explode.

As of Monday, the average rate on a 30-year, fixed-rate mortgage was 6.71%, according to Freddie Mac. That number is up from a recent low of just under 6.1% registered in late January and early February. The rate on an average 15-year, fixed-rate mortgage was 6.07%.

In a bright spot for the economy, there have been several months of strong job gains. Recent employment reports have proven surprisingly resilient, with the unemployment rate hovering around multidecade lows.

The economy blew past expectations in May and added another 339,000 jobs, showing labor market fortitude despite the rate hikes.