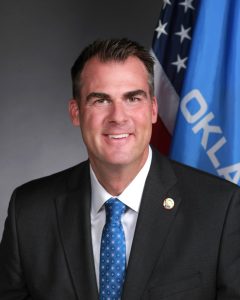

Shoppers walk at a store during Black Friday sales in the Manhattan borough of New York on Nov. 26, 2021. (Jeenah Moon/Reuters)

Shoppers walk at a store during Black Friday sales in the Manhattan borough of New York on Nov. 26, 2021. (Jeenah Moon/Reuters)

By October 10, 2022 Updated: October 10, 2022. Media: The Epoch Times.

U.S. online holiday sales are expected to rise this year at their slowest pace since at least 2015, according to a report, as shoppers feel the brunt of decades-high inflation and soaring interest rates.

Adobe Analytics forecast online sales in November and December to rise 2.5 percent to $209.7 billion, compared with an 8.6 percent increase a year ago, as more people also return to in-store shopping and bring forward purchases to as early as October.

This is another sign of a gloomy holiday season, with FedEx Corp.’s Ground division expecting to lower volume forecasts to reflect customers’ plans to ship fewer holiday packages. Last month, Mastercard’s SpendingPulse report also forecast a slowdown in shopping for the holidays.

With annual inflation running 8.3 percent in August, Americans have been forced to cut back on discretionary purchases, while the U.S. Federal Reserve’s aggressive interest rate hikes are expected to further hit spending power.

“This is a radically different year than even any of the COVID fluctuations that we’ve seen in the past,” Adobe Digital Insights senior director Taylor Schreiner said.

“As the cost of basics like food and gas go up, consumers become much more price-conscious shoppers … and that influences consumers’ plans to wait for discounts and shop a little more vigilantly over the course of the season,” Schreiner said.

Companies such as Amazon.com Inc., Target Corp., Walmart Inc., and Best Buy Co. Inc. have been delving out early discounts to spur demand and get rid of excess stock, eating into the expected sales on major shopping days. Adobe expects discounts for electronics to be around 27 percent, compared to 8 percent a year ago.

Black Friday online sales are expected to grow just by 1 percent and Thanksgiving sales are anticipated to fall 1 percent, the Adobe report said.

Adobe’s forecast relies on direct consumer transactions based on over 1 trillion visits to U.S. retail websites.

By Ananya Mariam Rajesh and Aatrayee Chatterjee

Discussion about this post