By Eric Revell. Media: Fox Business.

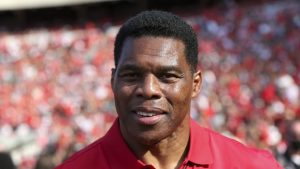

Paul Pelosi, the multimillionaire husband of former House Speaker and current Rep. Nancy Pelosi, D-Calif., sold 30,000 shares of Google stock a month prior to the Dept. of Justice’s announcement of an antitrust lawsuit against the tech giant, according to a financial disclosure filed with the House of Representatives.

Pelosi reported the sale of Google stock in three different transactions between Dec. 20 and Dec. 28, 2022, each of which involved the sale of 10,000 shares of stock in Google’s parent corporation Alphabet Inc. The Periodic Transaction Report filed with the House notes that each transaction involved an amount between $500,001 and $1,000,000 and yielded capital gains of more than $200 — although it’s unclear how large the profit was. Taken together, the trades involved 30,000 shares and between $1.5 million and $3 million of assets.

The DOJ and eight states announced a lawsuit against Google on Tuesday, alleging that the company engaged in anticompetitive behavior and exercised a monopoly over internet search traffic.

“Google’s anticompetitive behavior has raised barriers to entry to artificially high levels, forced key competitors to abandon the market for ad tech tools, dissuaded potential competitors from joining the market, and left Google’s few remaining competitors marginalized and unfairly disadvantaged,” the DOJ and the states allege.

The Pelosi family’s stock transactions have attracted scrutiny in recent years. Prior to Congress’ passage of the CHIPS Act last year, which was ultimately signed into law and provided a roughly $52 billion subsidy to boost domestic computer chip production, Paul Pelosi bought between $1 million and $5 million in shares of Nvidia.

In July, a spokesman for then-Speaker Pelosi’s office told FOX Business that she “does not own any stocks” and “has no prior knowledge or subsequent involvement in any transactions.”

The spokesman said that Pelosi asked the House committee tasked with regulating members’ financial disclosures to “examine the issue of Members’ unacceptable noncompliance with the reporting requirements in the STOCK Act, including the possibility of stiffening penalties.” Legislation to ban members of Congress from trading stocks stalled at the end of the 117th Congress, although lawmakers have since reintroduced proposals on the subject.

Pelosi’s office did not immediately respond to FOX Business’ request for comment on this story.

Sen. Josh Hawley, R-Mo., introduced the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act this week, which would ban lawmakers in Congress from stock trading. Hawley reacted on Twitter to the news about the Pelosi family’s latest stock trade:

People have asked why I named my stock trade ban the PELOSI Act. Now you know https://t.co/qMKDNx5buK

— Josh Hawley (@HawleyMO) January 25, 2023

Efforts to increase oversight and promote transparency into lawmakers’ investments increased after revelations that then-Sen. Richard Burr, R-N.C., abruptly sold hundreds of thousands of dollars from his investment portfolio after he received a closed-door briefing in February 2020 on the potential impact of the COVID-19 pandemic.

Burr was investigated over the trades by the Securities and Exchange Commission, which announced earlier this month that it ended its probe without taking action against him.

It’s unclear if the current Congress will hold votes on legislation related to the dealings of lawmakers and their families on financial markets. One of the main laws on the subject that is currently on the books is the Stop Trading on Congressional Knowledge (STOCK) Act of 2012, which requires lawmakers to report stock trades to Congress within 45 days of completing a transaction.

The law also prohibited the use of non-public information for private profit, including insider trading by members of Congress and other government employees.

Fox Business’ Anders Hagstrom, Hillary Vaughn and Danielle Wallace contributed to this report.