People shop at a supermarket in Montebello, Calif., on Aug. 23, 2022. U.S. shoppers are facing increasingly high prices on everyday goods and services as inflation continues to surge with high prices for groceries, gasoline, and housing. (Frederic J. Brown/AFP/Getty Images)

People shop at a supermarket in Montebello, Calif., on Aug. 23, 2022. U.S. shoppers are facing increasingly high prices on everyday goods and services as inflation continues to surge with high prices for groceries, gasoline, and housing. (Frederic J. Brown/AFP/Getty Images)

By October 3, 2022 Updated: October 3, 2022. Media: The Epoch Times.

While food prices remain elevated and customers look for cheaper deals, supermarkets have begun to limit the discounts they provide and are running fewer promotions.

In the third quarter, food and beverage products were sold with a 20.6 percent price reduction on average, which is less than the 25.7 percent discount during 2019, a Wall Street Journal report said, citing data from research firm Information Resources Inc. (IRI). Except for meat, promotional levels for all grocery categories are down when compared to 2019.

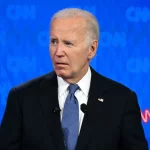

The rate of 12-month food inflation rose by 11.4 percent in August, according to data from the U.S. Bureau of Labor Statistics (BLS). This is up from 3.8 percent in January 2021, when Joe Biden assumed the presidency.

Compared to a year ago, August 2022 prices for white bread in U.S. cities were up by 19.7 percent per pound, ground beef up by 10.5 percent, whole chicken up by 27.6 percent, and a dozen eggs up by 82.3 percent.

Kosta Drosos, general manager of Fresh Market Place in Chicago, Illinois, said to The Wall Street Journal that his store has not run any discounts on milk products for almost five months. The special sales held by the store tend to be for items other than staples. And even these promotions tend to be small.

Though Fresh Market is running promotions on some proven sellers, the store is bearing losses on such campaigns. “It’s hard to run anything on promo,” he said.

Kraft Heinz, the third-largest food and beverage company in North America, is offering discounts at a lower level than in 2019, around the time the pandemic began.

Lower Sales, Changing Shopping Behavior

In response to high food inflation, low-income shoppers are scaling back on their food purchases, according to a press release by IRI on Sept. 12. This demographic was responsible for much of the food and beverage sales growth in 2021. High food inflation is also driving down sales at stores.

“Overall, retail food and beverage unit sales declined 4.5 percent compared to a year ago, and volume sales declined 4.0 percent. The most significant drop-offs in volume are in categories where prices have risen dramatically, including frozen dinners/entrees, cookies, and coffee,” noted IRI in the release.

Customers were also found to be bargain hunting more, with trips to food and beverage stores rising by 3.5 percent on an annual basis for the week ended Aug. 21. Quick trips to stores were up by 6.7 percent.

According to a report by consumer research platform Attest, more than 50 percent of American consumers are reducing spending on groceries by selecting cheaper brands, while 46.7 percent are strictly sticking to their budgets.

More than 40 percent are buying less food, 46.1 percent have switched to buying cheaper foods, and 33.4 percent are now visiting cheaper stores.